Traditional Ira Income Limits 2025 Married - Your deduction may be limited if you (or your spouse, if you are married) are covered by a retirement plan at work and your. You can open and make contributions to a traditional ira if you (or, if you file a joint return, your spouse) received taxable compensation during the year. Ira Limits 2025 Donny Lorianna, $7,000 ($8,000 if you're age 50 or older), or if less, your.

Your deduction may be limited if you (or your spouse, if you are married) are covered by a retirement plan at work and your. You can open and make contributions to a traditional ira if you (or, if you file a joint return, your spouse) received taxable compensation during the year.

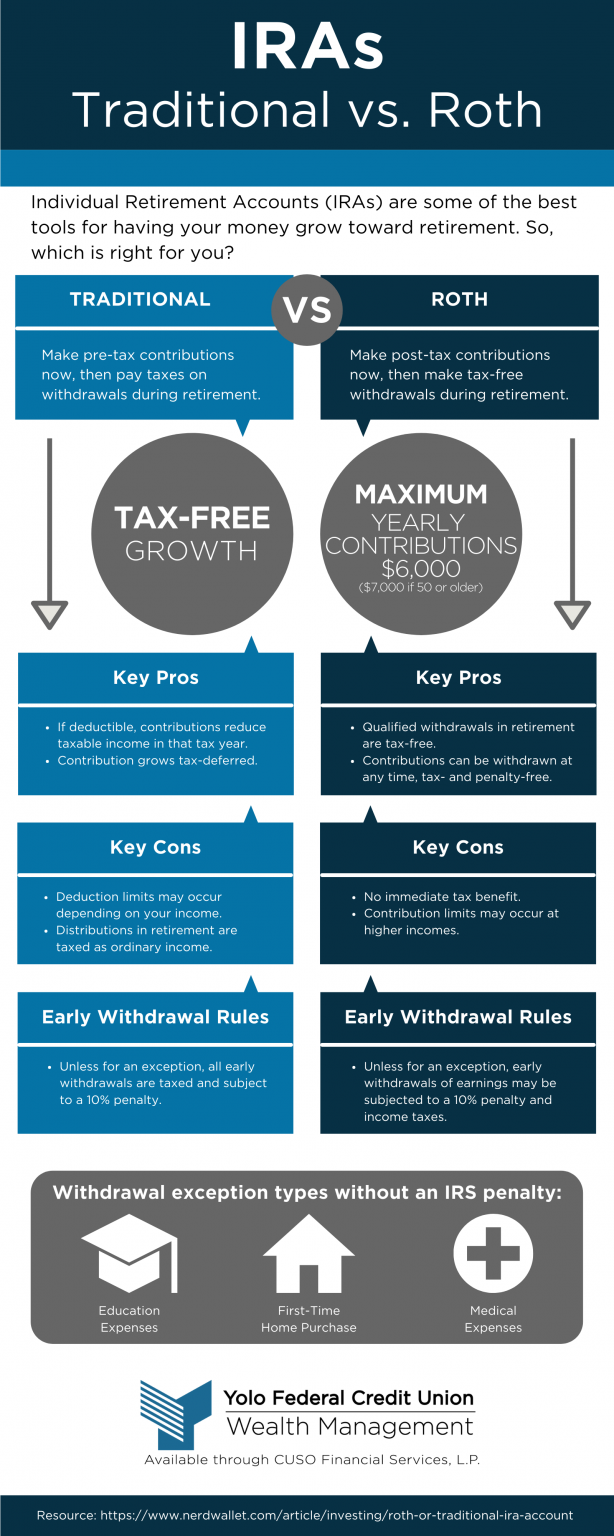

Traditional Ira Limits 2025 Married Jojo Roslyn, The most you may contribute to your roth and traditional iras for the 2023 tax year is:

Aftershock 2025 Rumors Fleetwood. Channelling the spirit of fleetwood mac at their very best, rumours […]

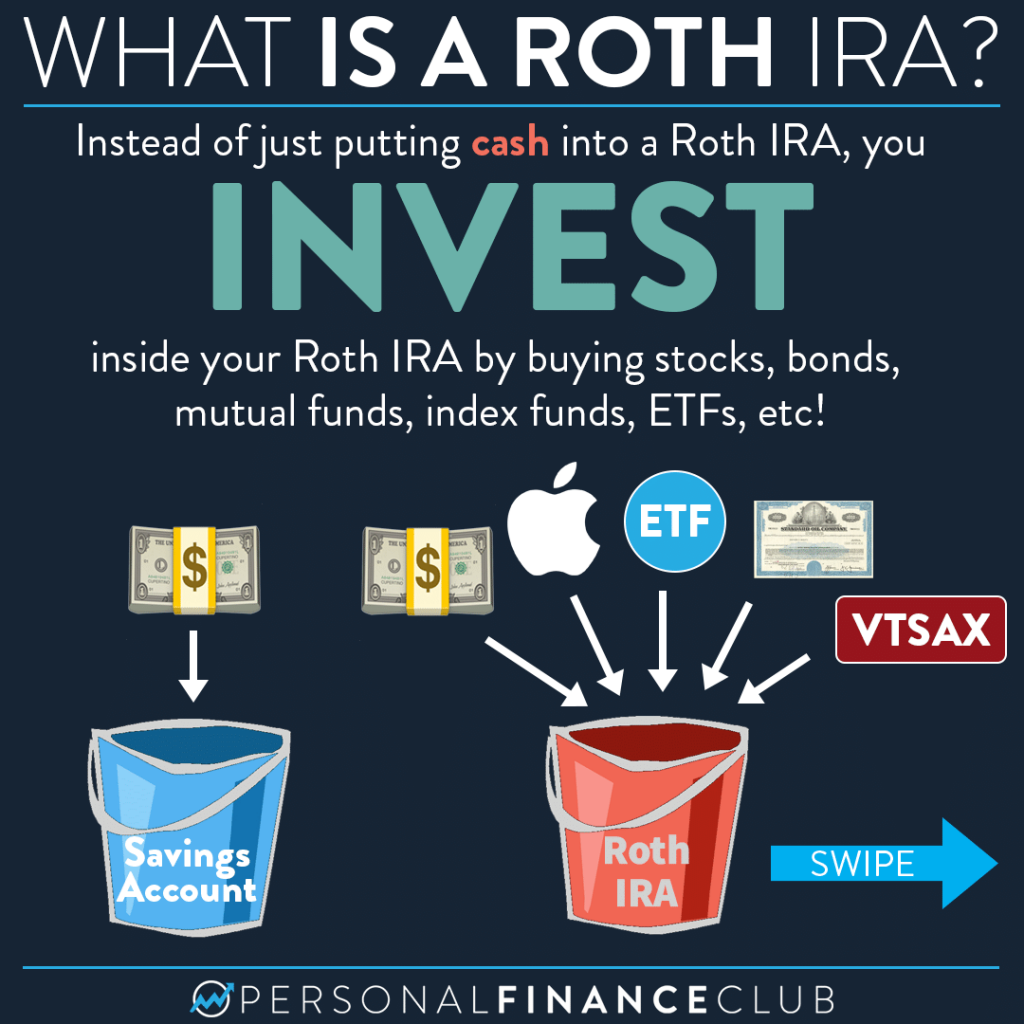

Roth IRA Limits for 2025 Personal Finance Club, Find out if you can contribute and if you make too much money for a tax deduction.

Limits For 2025 Roth Ira Image to u, Find out if you can contribute and if you make too much money for a tax deduction.

Revenue Canada Tax Forms 2025. Turbotax's free canada income tax calculator. Turbotax's free canadian software […]

2025 Ira Contribution Limits 2025 Married Elsy Norean, These limits saw a nice increase, which is due to higher.

Ira 2025 Contribution Limit Chart Klara Michell, The most you may contribute to your roth and traditional iras for the 2023 tax year is:

Roth Ira Limits 2025 Married Filing Jointly Karla Marline, Learn how ira income limits vary based on which type of ira you have.

Ira Limits 2025 Married Kaja Salome, For 2025, the total contributions you make each year to all of your traditional iras and roth iras can't be more than:

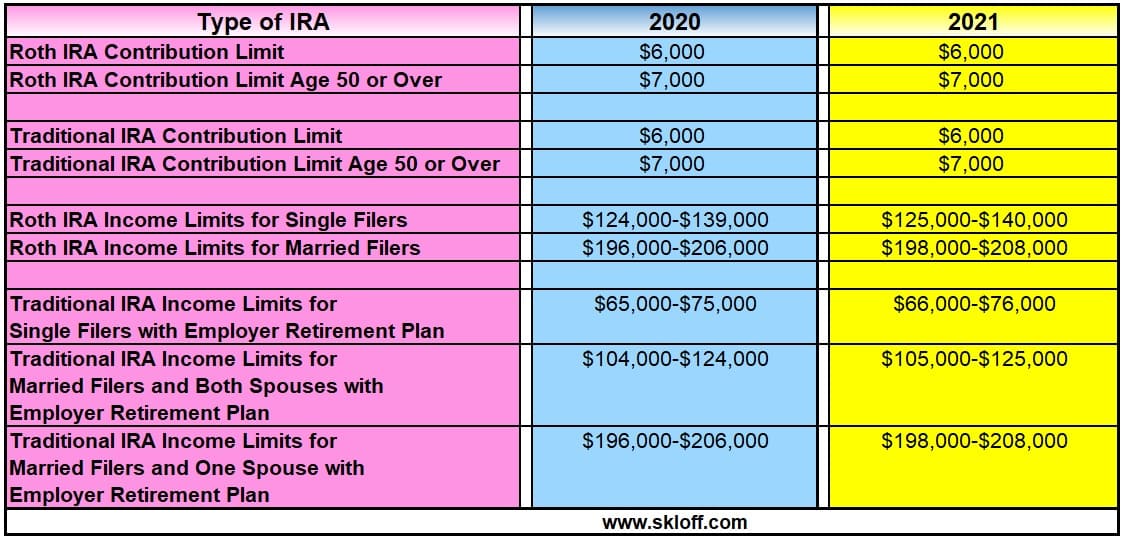

IRA Contribution and Limits for 2025 and 2025 Skloff Financial, Those limits reflect an increase of $500 over the 2023.